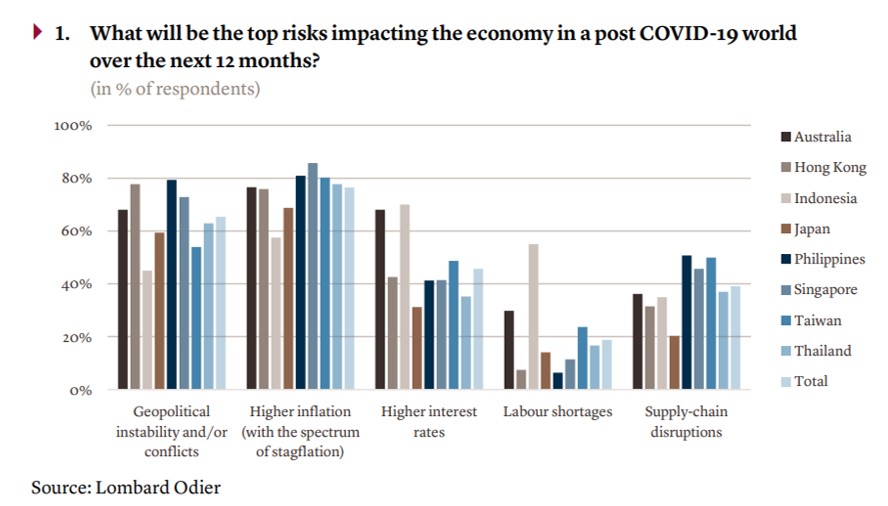

A survey of Asia-Pacific high net worth individuals by shows that they are particularly worried about inflation, market volatility and missing out on opportunities.

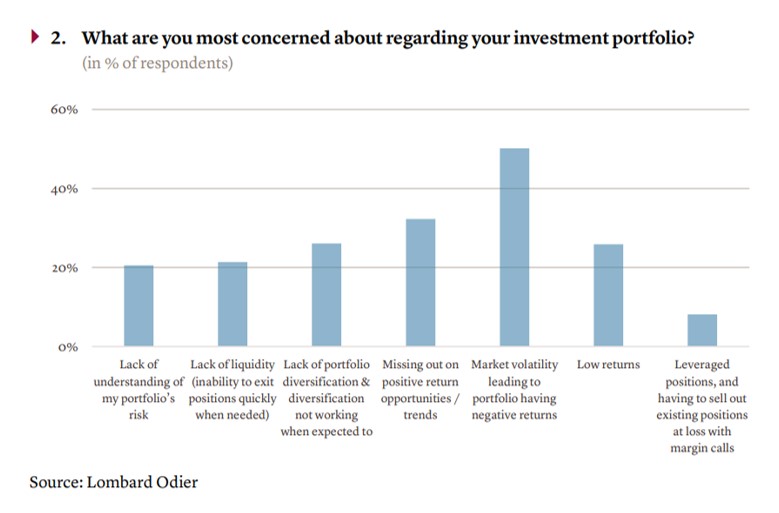

Market volatility is “by far” the main concern for respondents to the Swiss private bank’s survey, with half of them worried about it. Lombard Odier polled 450 people across the region for its 2022 HNW Individuals Study. People included in the study come from Singapore, Hong Kong, Japan, Thailand, the Philippines, Indonesia, Taiwan and Australia.

Rising inflation and its impact is the biggest risk to the global economy, according to 77 per cent of Asia-Pacific high net worth individuals. Some 87 per cent of Singapore HNWIs claimed this as their top risk, the highest percentage among countries analysed.

“We are in the midst of a fundamental shift in our global economy pegged with an outlook that is uncertain and gloomy. APAC investors are becoming more conservative in their portfolio construction and are diverting to ‘safer’ alternative and private assets, whilst increasingly diversifying beyond their local markets,” Vincent Magnenat, limited partner, global head of Strategic Alliances and Asia Regional head at Lombard Odier, said. “Above all, risk assessment and management take priority. This is where a robust portfolio construction process from private banks comes into play.”

Diversity

A global mix for their portfolios is increasingly favoured by survey respondents. Exposure of HNW individuals to their domestic market has decreased in the past two years. Singapore respondents are diversifying away from their domestic market to the greatest extent, with more than half (59 per cent) holding less than 20 per cent exposure to the domestic market.

Respondents are also taking a more conservative approach and repositioning their portfolios, diverting from more traditional asset classes such as equities and bonds towards investing in their own company (a 27 per cent increase), “safer” assets such as gold and cash (a 44 per cent increase), and in alternative and private equity assets (a 37 per cent increase) over the past two years.

A prominent concern, the study found, is missing out on opportunities (32 per cent). APAC respondents think they live in a time of opportunity, but they will mainly invest in underlying assets whose volatility can be measured and managed efficiently. Low returns are also feared (26 per cent); most likely because of soaring inflation and a loss of purchasing power, or from anticipating recession in the US and Europe. Overall, respondents project that expected returns will be lower in future, which is a worry, especially if high inflation is to persist.

Private assets

Interest in private assets is on the rise with Singapore and Australia leading the trend. 60 per cent of Singapore HNW individuals and 57 per cent of Australian wealthy individuals intend to increase their allocation.

The enthusiasm for private assets is reflected in the low liquidity concerns of respondents, particularly among the older generations. APAC investors seem to think that private assets allow them to capture structural changes in a regulated and risk-managed way.

Crypto sceptics

Respondents aren’t active in cryptocurrencies. The majority – 83 per cent – have no crypto investments or less than 5 per cent of their portfolio invested.

HNW individuals in Indonesia, Hong Kong and Taiwan have more confidence, with the proportion of respondents holding crypto in their portfolios at 70 per cent, 59 per cent and 55 per cent respectively.

Technology is an enabler, but the physical presence of bankers and advisors will continue to play a key role. Respondents continue to value a more personal relationship with their banks, with 82 per cent believing that advice cannot be fully automated.

The report said that “sustainability” is now seen as a legitimate investment opportunity. This perception is the strongest among people in Taiwan, Thailand and Japan. The share of respondents holding sustainable assets is rising, although a significant number of them (45 per cent) hold less than 20 per cent of sustainable investments in their portfolios.

Younger generations face more barriers to convincing older generations about sustainable investments. Barriers include the relative underperformance of financial returns (41 per cent), a lack of investment opportunities with proven track records (36 per cent), and the lack of understanding of what sustainable investment really is (33 per cent).